A loan is a sum of money borrowed from a creditor that you pay back with interest. Loans can be secured or unsecured.

Amrita Jayakumar is a former staff writer at NerdWallet and, later, a freelance contributor to the site. She has covered personal loans and consumer credit and debt, among other topics, and wrote a syndicated column about millennials and money. Previously, she was a reporter at The Washington Post. Her work has appeared in the Miami Herald and USA Today. Amrita has a master's degree in journalism from the University of Missouri.

Lead Assigning Editor Kim Lowe

Lead Assigning Editor | Consumer lending

Kim Lowe is a lead assigning editor on NerdWallet's loans team. She covers consumer borrowing, including topics like personal loans, student loans, buy now, pay later and cash advance apps. She joined NerdWallet in 2016 after 15 years at MSN.com, where she held various content roles including editor-in-chief of the health and food sections. Kim started her career as a writer for print and web publications that covered the mortgage, supermarket and restaurant industries. Kim earned a bachelor's degree in journalism from the University of Iowa and a Master of Business Administration from the University of Washington. She works from her home near Portland, Oregon.

Fact CheckedMany, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

A loan is a sum of money that you borrow from a financial institution — a bank, credit union or online lender — or a person, like a family member, and pay back in full at a later date, typically with interest.

All loans have similar attributes. There are different types of loans, depending on what you use them for.

Loans generally have four primary features: principal, interest, installment payments and term. Knowing each of these will help you understand how much you’ll pay and for how long, so you can decide if a loan fits in your budget.

Principal: This is the amount of money you borrow from a lender. It may be $500,000 for a new house or $500 for a car repair. As you repay your loan, the principal is the outstanding balance aside from interest or fees.

Interest: The interest rate is the cost of a loan — how much you have to pay back in addition to the principal. Lenders determine your interest rate based on several factors, including your credit score, the type of loan and how much time you need to repay it.

The interest rate can differ from the annual percentage rate , or APR, which is the interest rate plus other costs like upfront fees.

Installment payments: Loans are usually repaid at a regular cadence, typically monthly, to the lender. Your monthly payment is commonly a fixed amount.

Term: The loan term is how much time you have to repay the loan in full. Depending on the type of loan, the term can range from a few weeks to several years.

While loans are typically installment credit, meaning you borrow a lump sum and repay it over time, lines of credit and credit cards are forms of revolving credit . Unlike loans, revolving credit lets you access money as you need it, pay it back and then borrow more. You only pay interest on the money you borrow.

Here’s a snapshot of several different types of loans, as well as their terms and interest rates.

Typical interest rate

Loans fall into two broad categories: secured and unsecured.

Examples: A mortgage or an auto loan.

With a secured loan , the lender typically uses a physical asset, like your home or car, to secure its money if you cannot repay the loan as agreed. The lender bases your interest rate on the asset as well as your credit score and credit history. Secured loans typically have lower interest rates than unsecured loans.

Examples: A student loan, a personal loan or a payday loan.

Lenders offering unsecured loans base your interest rate on your credit score, credit history, income and existing debt. If you don't pay back the loan as agreed, the lender can't seize any of your assets, but it can report the default to the three major credit bureaus , which will hurt your credit score and possibly your ability to borrow in the future.

Unsecured loans typically have higher interest rates than secured loans.

The process of getting a loan varies depending on the type of loan you’re seeking. Generally, a lender will review your credit score, income and existing debts to decide whether to approve your loan application. If the loan is secured, the lender will also evaluate the collateral.

For mortgage and car loans, you can typically get pre-approved before you start home or car shopping. This process may require a hard credit check and gives you a sense of how much you’ll be approved for what your interest rate will be.

For personal loans, you can often prequalify to preview your potential loan amount and rate. Prequalification doesn’t require a hard credit check, so you can compare offers from multiple personal loan lenders with no impact to your credit score.

Lenders that don’t check your credit or ability to repay a loan often charge high interest rates. For example, the average payday lender charges a $15 fee for every $100 you borrow, according to the Consumer Financial Protection Bureau, which equates to an APR of nearly 400%. Consumer advocates say loans with APRs above 36% tend to be unaffordable.

Once you’ve signed a loan contract and the lender disburses the funds, you’ll start repaying the loan in regular, usually monthly, installments.

If you miss a payment, your lender could charge a late payment fee. Most reputable lenders report loan payments to the credit bureaus, meaning missed payments will hurt your score and on-time payments can help build it.

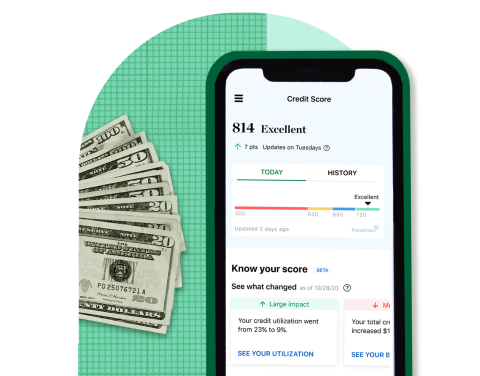

Be ready for any loan application NerdWallet tracks your credit score and shows you ways to build it — for free. GET THE SCOOP

You’re following Amrita Jayakumar

Visit your My NerdWallet Settings page to see all the writers you're following.

Amrita Jayakumar is a former staff writer at NerdWallet and, more recently, a freelance contributor to the site. She previously worked at The Washington Post and the Miami Herald. See full bio.

On a similar note.

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution's Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105